INVESTMENT TIP – 27/11/25

SELL COLES (COL) + BUY WOOLWORTHS (WOW)

Coles and Woolworths are Australia’s two dominant supermarket operators, each generating highly defensive, recurring earnings from food and everyday-needs retailing. Coles operates a national network of supermarkets and liquor stores with a strong operational focus on cost reduction, supply-chain simplification and automation. Woolworths is Australia’s #1 food retailer with a broader network across Australia and New Zealand, and additional exposure to foodservice (B2B) and the growing W-Living division (Big W and Petstock). Both companies provide stable cashflows, non-discretionary earnings and comparable fully-franked yields in the 3–3.5% range.

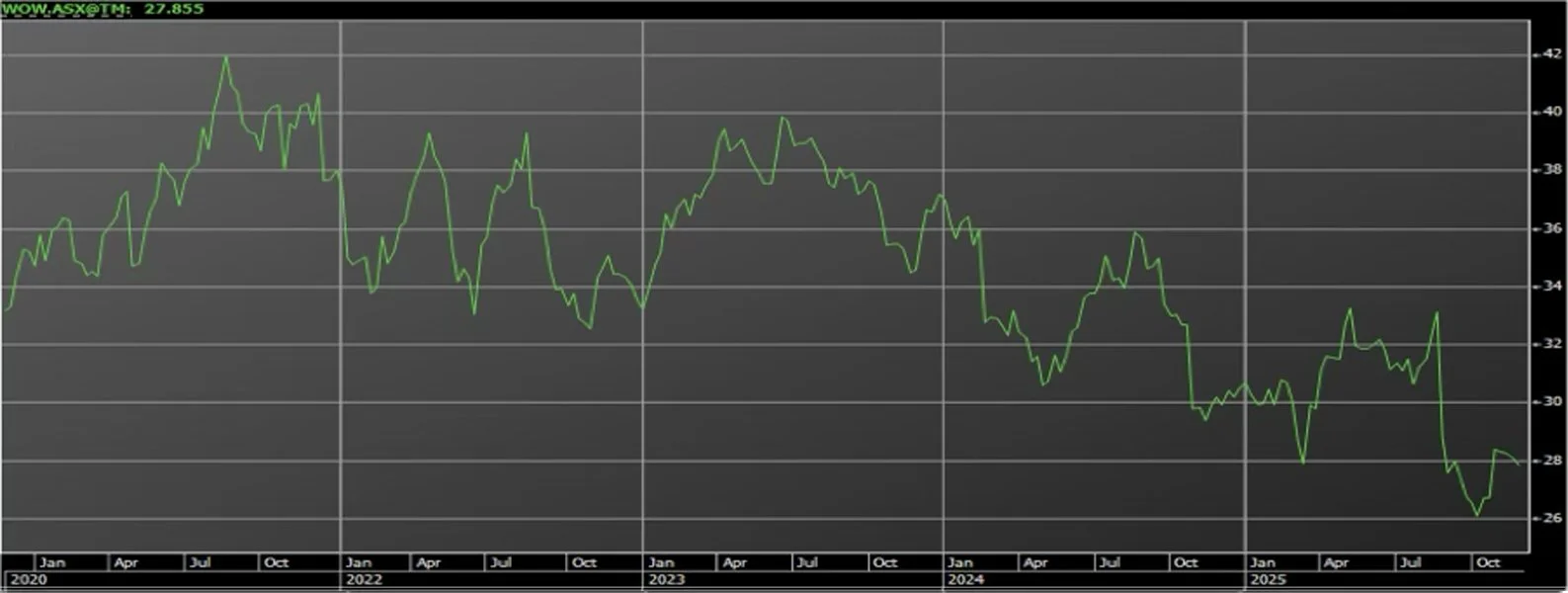

However, valuation and cycle positioning now favour Woolworths over Coles. Coles is currently trading near its five-year highs and at a noticeable premium to Woolworths on forward valuation metrics. Since the demerger from Wesfarmers in 2018, Coles investors are sitting on significant capital gains, and the stock’s re-rating over the past 12–18 months means that much of the near-term upside now appears priced in. By contrast, Woolworths - having fallen from over $40 to around $28 - has materially de-rated, creating a valuation gap that historically does not persist for long between the two majors (see charts below).

A key reason for Woolworths’ share price weakness has been a two-year period where its earnings repeatedly came in softer than expected. Importantly, this now appears to be turning around. Recent results showed the first signs of stabilisation across the business, including stronger supermarket trends, better performance from its foodservice division (which supplies cafés, restaurants and hospitals), and improving momentum in Big W and Petstock. These areas matter because they give Woolworths growth outside its core supermarkets. With these parts of the business now improving at the same time, analysts see this as the point where the earnings downgrade cycle has likely ended. This marks a meaningful shift in sentiment and gives Woolworths greater potential for recovery and re-rating relative to Coles.

Finally, the switch preserves exposure to defensive, income-generating staples, which remains appealing given how far broader Australian market valuations have run. Both stocks offer similar dividend yields, but Woolworths provides superior upside potential in its share price from here due to its discounted valuation, improving earnings trajectory and likelihood of re-rating. Selling Coles into strength and rotating into Woolworths at cycle-low sentiment and depressed prices offers a better risk-reward profile while maintaining defensive positioning within a portfolio and a solid yield of 3-3.5% (fully franked).

COL 5 YEAR

Source: IRESS

WOW 5 YEAR

Source: IRESS

Important Disclaimer

The directors, employees and authorized representatives of PPN Wealth do not guarantee the information in this report to be complete, up to date, accurate nor applicable to your personal circumstances. This is general investment advice only. You should not act on recommendations in this report without discussing proposed actions with your PPN Wealth adviser to ensure recommendations are suitable to your circumstances.

The principals, associates and employees of PPN Wealth may have investments in the securities or companies, referred to in this report.

This report may not be distributed in any way without the prior permission PPN Wealth. The directors, employees and authorized representatives of PPN Wealth do not accept any liability for third parties’ actions relating to this report.