NEWS + VIEWS – 10/10/2025

MARKETS

Share markets globally continue their uptrend since the April lows caused by the Trump tariff announcements, most of which is related to technology companies feeding off AI demand expectations.

Expected interest rate cuts and GDP growth are also stimulating share markets both domestically and offshore. Of course, there needs to be something to worry about and higher inflation readings are keeping investors on edge.

GDP GROWTH IN THE US

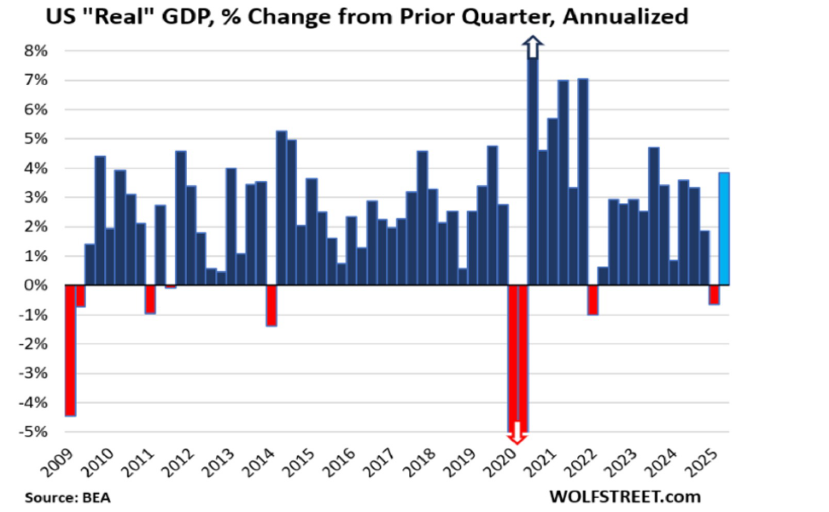

The chart below shows that second quarter US GDP growth in ‘real’ terms (i.e. over and above inflation) rose 3.8% (annualised), which is a robust rate of growth. Increased consumer spending by optimistic Americans and capital investment growth were key contributors to the result. In Australia, the latter is declining.

The healthy growth rate has been overlaid on company earnings by analysts (higher profit expectations), which in turn is pushing up share prices. Of course, these are predictions of an always uncertain future and there are no assurances that higher profits will be realised.

Discussions on whether the higher share prices are forming a bubble are increasing in the media. Share markets are almost certainly in ‘overbought territory’ and need earnings to ‘catch up’.

The key risks as we see them are:

Geopolitical; these are generally shrugged off very quickly, unless of course it is a major event.

Inflation returns and interest rate cuts are deferred or rates even rise. The stellar rise of the price of gold suggests that investors are concerned about high US government spending triggering inflation and a weaker US dollar.

The AI boom disappoints in its expected positive effects on company operations, which would potentially have a significant impact on technology stocks.

Company profits do not meet the high expectations built in to share prices.

While we do not know what will happen to share markets, past trends have an ability to ‘predict’ what happens more often than not.

September tends to be a weak month of the year for shares but that didn’t happen this year. Markets were flat in Australia but well up in the US. October tends to be the most volatile month, albeit generally a positive one. November can often see the start of the ‘Santa rally’ where share markets rise into the New Year.

COMPANY NEWS

Reports out of China suggest that steelmakers have been instructed not to purchase iron ore from BHP. However, different stories are emerging from different Chinese entities. The Chinese government has a history of interposing itself into trade negotiations. Readers might recall the gaoling of Rio Tinto (RIO) executive Stern Hu in 2009 during tense negotiations.

CSL remains under pressure as its CFO resigned last week in response to the poor reaction to the company’s last set of results. An increase in investor interest will probably require profit guidance to be met or exceeded and clarity over why the demerger of the Seqirus flu vaccination operations is a strategic positive. CSL have projected profit increases of around 7%, which would be solid and depending on the quality of the result, may suggest that the current share price is low. Analysts generally have a positive outlook on the company at current share prices.

ANZ, NAB and Westpac (WBC) are due to report their half year profit results in early November. Of interest will be what impact housing price rises have on new lending.

Gerard O’Shaughnessy

P 0423 771 330

Important Disclaimer

The directors, employees and authorized representatives of PPN Wealth do not guarantee the information in this report to be complete, up to date, accurate nor applicable to your personal circumstances. This is general investment advice only. You should not act on recommendations in this report without discussing proposed actions with your PPN Wealth adviser to ensure recommendations are suitable to your circumstances.

The principals, associates and employees of PPN Wealth may have investments in the securities or companies, referred to in this report.

This report may not be distributed in any way without the prior permission PPN Wealth. The directors, employees and authorized representatives of PPN Wealth do not accept any liability for third parties’ actions relating to this report.