NEWS + VIEWS – 30/01/2026

MARKETS

The US share market this week reacted to a swathe of corporate earnings and the Federal Reserve’s decision to keep interest rates on hold. Technology stocks came under pressure after Microsoft fell around -10% on weaker cloud growth and guidance, which reignited concerns about heavy AI-related spending. Meanwhile, concerns about potential conflict with Iran helped push oil prices higher.

A surge in commodity prices helped lift the Australian market, even as inflation data and the possibility of an interest rate rise weighed on broader sentiment. The Australian dollar rallied as a result of the domestic data as well as the weakness in the US dollar.

EUROPE HOLDS THE CARDS AS US DEBT MOUNTS

According to Canadian prime minister Mark Carney, the so-called ‘rules-based global order’ is finished. The United States’ view of the world has changed fundamentally. After eight decades of depending on close alliances, it has shifted toward a far more ruthless approach - one resembling a survival-of-the-strongest mentality, where power is exercised without restraint.

Recent events have shocked diplomats: US aggression toward Venezuela, the abduction of its president, and relentless pressure on Denmark to surrender Greenland. At the same time, harsh attacks on the US Federal Reserve and its leadership have unsettled financial markets worldwide.

“Call this system what it is,” Carney told the World Economic Forum in Davos last week. “A period where the most powerful pursue their interests using economic integration as a weapon of coercion.”

Few understand this system better than Carney. Having led both the Bank of Canada and the Bank of England, he is keenly aware of the risks to global stability posed by President Donald Trump’s abrupt policy shifts. However, since Carney also sees a major weakness in America’s position, he is prepared to stand up to Trump.

The United States is carrying an enormous debt of around $US38 trillion and adding roughly $US2 trillion more each year. A country that deeply indebted cannot afford to alienate its allies, particularly when tax cuts are making the situation worse. Servicing that debt alone now costs nearly $US1 trillion annually, making interest payments the second-largest item in the US budget, surpassing even defence spending.

Investors are losing appetite

There’s another ‘rulebook’ in global finance that now risks being discarded - the unwritten one investors have relied on for decades. When markets go haywire, seek safety in the US. Buy US government debt, especially 10-year Treasury bonds.

Bonds are essentially IOUs, and US government bonds are seen as the global benchmark. Even when the US has triggered financial crises such as the GFC, investors have stuck to this strategy because America has long been considered the ultimate safe haven, the cornerstone of the financial system. US government bonds are deemed risk-free, with the expectation that Uncle Sam will never default.

Pinpointing when this mindset began to shift is difficult. One could argue that China’s deliberate move to reduce its holdings of US government debt around 2016 hinted at an early change, as Beijing sought to limit dependence on the US dollar amid a shifting world order.

But over the past year, and particularly in the last six months, investor attitudes have noticeably changed. Despite conflicts in the Middle East, Europe, and Africa, the US dollar has weakened, and demand for US government debt has declined.

This trend became especially clear last week as cracks in the NATO alliance emerged. Falling demand for US government debt has pushed American interest rates upward, which should be a worrying sign for the White House. If it continues, rising interest payments could eventually threaten the US’s financial dominance.

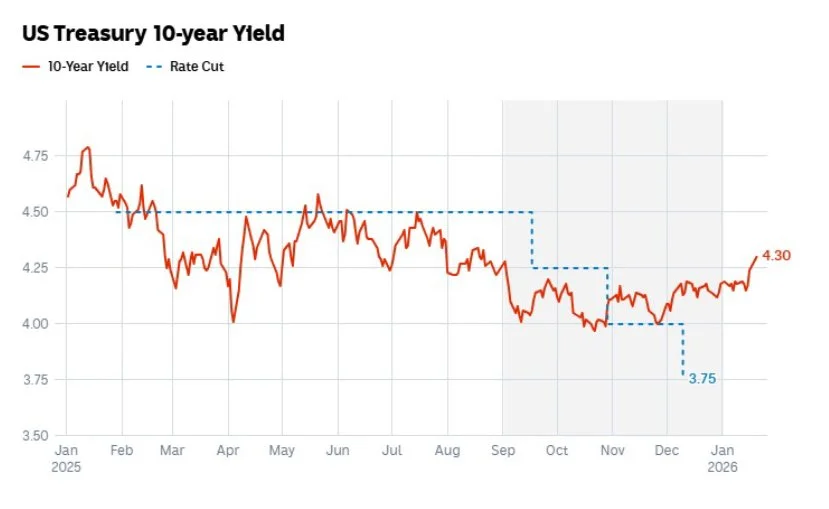

Source: US Federal Reserve

The chart above shows that the yield on 10-year government bonds has climbed from 4% last September to 4.30%, even after three rate cuts by the Federal Reserve. Meanwhile, the US dollar has been sliding for months.

Debt between friends

The US dollar remains dominant in global finance, but a significant shift occurred last year. It went largely unnoticed in the headlines, yet it has fuelled a major surge in precious metals. For the first time since 1996, global central banks added more gold to their reserves than US government debt. Led by China and India, they are moving away from paper assets toward hard ones.

However, the UK, France, Japan, Canada, Belgium, Ireland, and others have all increased their holdings of US Treasuries in recent years. European investors and central banks now hold roughly $US8 trillion in US government debt, which could give them potential leverage. Selling it all at once would devastate the US economy, sending interest rates skyrocketing. But such a move would also destroy their own investments and trigger a global financial crisis.

This situation underscores just how deeply America’s fortunes are intertwined with the rest of the world and how vulnerable it can be. For decades, the US has benefited from having the global reserve currency. Capital has flowed in from around the world, keeping interest rates low, while the strong dollar has allowed Americans to buy freely anywhere in the world. Trump and his MAGA supporters, somehow seeing this as an unfair advantage, are trying to dismantle complex global links, mystifying many in the process.

Despite Trump’s boasts about the revenue from tariffs, the US continues to rack up deficits and growing debt. Servicing that debt depends on global investors, including central banks, continuing to buy US bonds. Mark Carney understands this dynamic well, and at some point, he may need to remind Trump exactly who holds all those IOUs.

Important Disclaimer

The directors, employees and authorized representatives of PPN Wealth do not guarantee the information in this report to be complete, up to date, accurate nor applicable to your personal circumstances. This is general investment advice only. You should not act on recommendations in this report without discussing proposed actions with your PPN Wealth adviser to ensure recommendations are suitable to your circumstances.

The principals, associates and employees of PPN Wealth may have investments in the securities or companies, referred to in this report.

This report may not be distributed in any way without the prior permission PPN Wealth. The directors, employees and authorized representatives of PPN Wealth do not accept any liability for third parties’ actions relating to this report.